How do supermarkets promote their products? What are the key factors in securing a prime position on supermarket shelves? How can we increase in-store visibility? These are just some of the questions merchandising can answer.

Discover the secrets of in-store shelf layout and learn how to position products strategically to maximize their visibility. From the penetrating aisle to the checkout aisle, via the rule of thirds, we explore the different techniques used by retailers to attract customers' attention and boost sales.

Merchandising is an essential strategy for optimizing the presentation, layout and promotion of products in-store or online to boost sales and enhance the in-store customer experience.

In the specific context of supermarkets, it can be defined as a set of studies and application techniques implemented separately or jointly by distributors or producers with a view to increasing point-of-sale profitability and product sales, by constantly adapting the assortment to market needs and by representing merchandise appropriately.

In other words: it's the way for brands and distributors to increase the profitability of their brand or point of sale, thanks to a better assortment and the perfect presentation of products on the shelves.

The main aim of merchandising is to arouse consumers' interest, guide them to the right products, and create a visually appealing environment that encourages purchase. It can be divided into four sub-objectives, which are not interpreted in the same way by retailers and producers. Producers seek to achieve their objectives for their brands, while retailers work for their departments or stores.

Merchandising is based on a mantra that aims to ensure a company's growth and profitability. To achieve this, it's essential to offer the right product, in the right place, at the right time, in the right quantity, at the right price, and with the right information. By following the 4Ps of Marketing(Price, Shelf Positioning, Productand Promotion), brands and stores can understand their customers' needs, thus maximizing sales and strengthening their market position.

The assortment is theset of products and services offered by the store (the retailer).

A range is determined by its width, depth and height.

The assortment can vary over time, as certain families or products are seasonal. This is why it is important for a brand to follow the assortment plan, which will be dynamic throughout the year. For example, at Christmas, the poultry assortment is wider and deeper. At Easter, the chocolate assortment is also wider and deeper.

The assortment responds to different constraints and requirements, which may be both internal (linked to the distributor) or external (linked to customers or competitors).

The range is linked to the network:

The assortment is linked to the sales unit (store, department, etc.):

As a reminder, thecommercial unit, which can be physical or digital, is the place where customers can access all the products and/or services sold by a retailer. The commercial unit (CU) must respect several constraints:

The range is linked to the offer:

It's all very well to want to sell a product, but it has to be available. To build up their assortments, chains take into account the products offered by their national and local suppliers.

They also pay close attention to the offerings of their direct competitors.

The range is linked to demand:

This is perhaps the most complex point, as it is based on behavioral and societal analyses:

Assortment objectives differ depending on whether you're a distributor or a producer. The producer seeks to meet the objectives of his brands, while the distributor works for his department or store.

That said, what are they?

Satisfying customer demand is very complicated, because two expectations are mechanically opposed. The first is to be able to find everything the customer wants, while the second is to be able to find it quickly, so as to reduce shopping time.

As you can see, if we increase the number of references to satisfy the first expectation, it will take longer to find the reference in question.

On the other hand, if we reduce the number of references, consumers will shop faster, but will be disappointed not to find the reference they want.

It all depends on where the product is sold. It could be a central retailer, a store, or a department manager.

To build their assortments, central purchasing agencies, stores and department managers rely on analyses from a variety of sources:

All these sources of information are essential for building an adapted assortment and meeting customers' needs.

Quantity depends on Market Share. If tomato sauce has a market share of 10% in the grocery aisle, it will represent 10% of the assortment.

Please note that sales figures vary from national to local! Galettes and crêpes have a much higher market share in Brittany than in Auvergne...!

It is important to determine the consumer's purchasing criteria and to prioritize them:- 1. pasta 2. organic 3. wholewheat- 1. wine 2. red 3. with medal

The assortment will then be divided as follows:

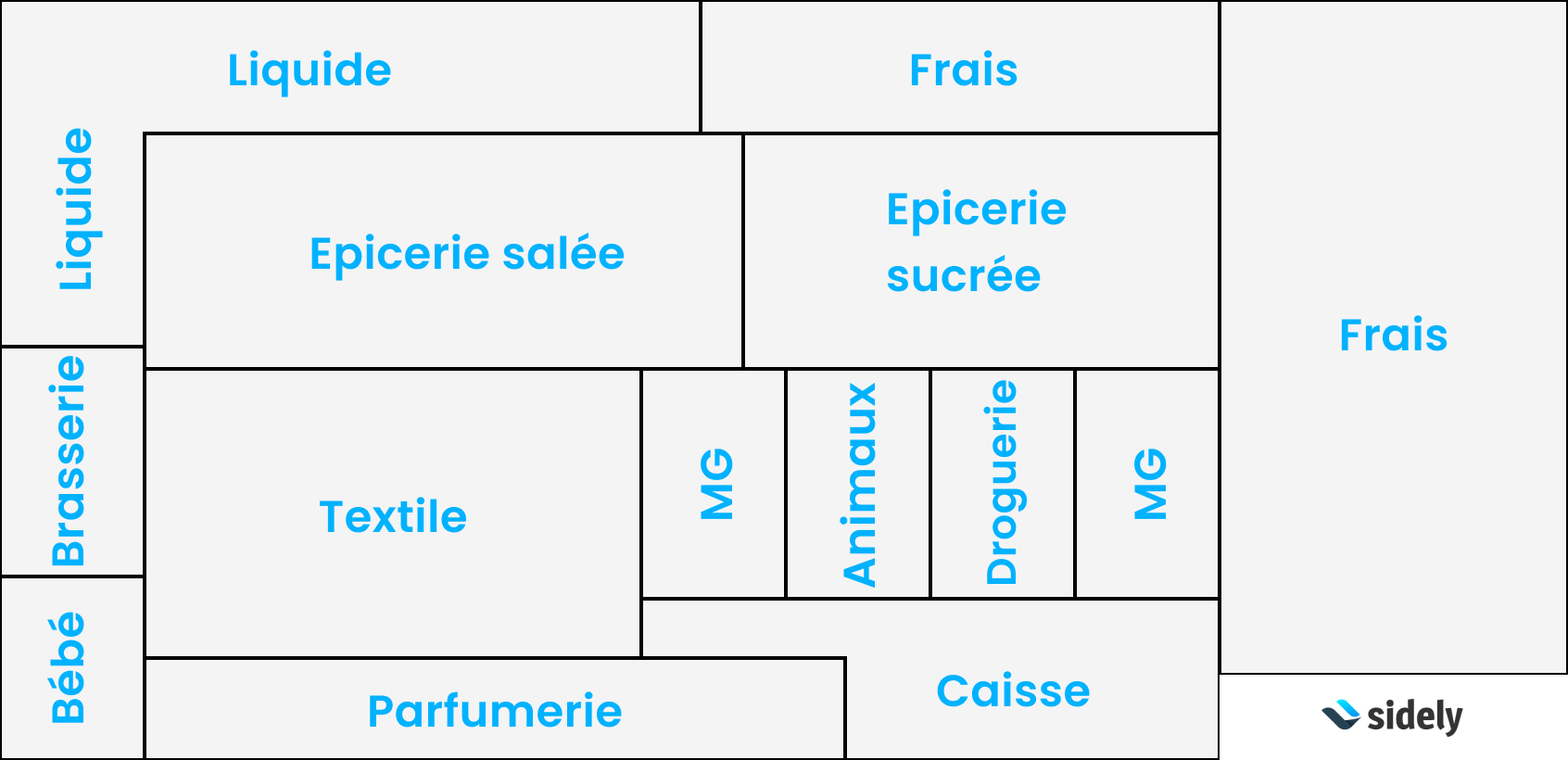

The overall floor plan is the general layout of the store. There are three main types of layout:

We're seeing an evolution in supermarket layouts. Plans are increasingly hybrid, mixing grid and free-standing layouts.

Economic profitability and customer satisfaction are still the main objectives when it comes to implementation. Nevertheless, certain constraints must not be overlooked:

These constraints are less important in rural stores, where space is at a premium. On the other hand, they can become crucial in urban environments.

Did you know that in our society, we tend to turn right? That's why labyrinth architects created dead ends if you turned right. If you want to win, turn left! In supermarkets, we use the same principle. At the entrance, on the right you'll find products you don't really need, known as "pleasure buys", and on the left, very attractive products, known as "reminders". In this way, the consumer is invited to navigate in a zigzag pattern. The aim is to make them stay as long as possible!

Superstore universes refer to specific areas or sections dedicated to similar products or product categories. Each universe usually has a particular theme or purpose, to meet consumers' needs or to highlight specific products. They comprise several categories with complementary and substitute products.

Here is an example of a universe breakdown:

There are different types of aisle, each with its own specific characteristics, which have a direct impact on customer behavior:

In green, the penetrating alley. This is the busiest aisle. It's where all the customers come in. It features seasonal products and big promotions.

In yellow, the central aisle. This is the most important aisle in the store. It's the one that crosses the store. It's perfect for 'Gondola Head' promotions.

In orange, the checkout lane. This is the slowest aisle. It's where everyone exits. It's ideal for impulse purchases.

In red, the perimeter aisle. Its importance depends on the retailer's policy.

In purple, the secondary aisle. It gives access to product families. It's the back of the aisle.

Hot zones are the areas with the most traffic and where customers spend the most time. Cold zones are the opposite: the areas with the least footfall and where customers spend the least time. The challenge for stores is to get customers to pass through these cold zones. For example, in a supermarket, the peach section will be colder than the savoury section.

This logic is not limited to the store. In the same department, there are hot and cold zones. This is known as the rule of thirds.

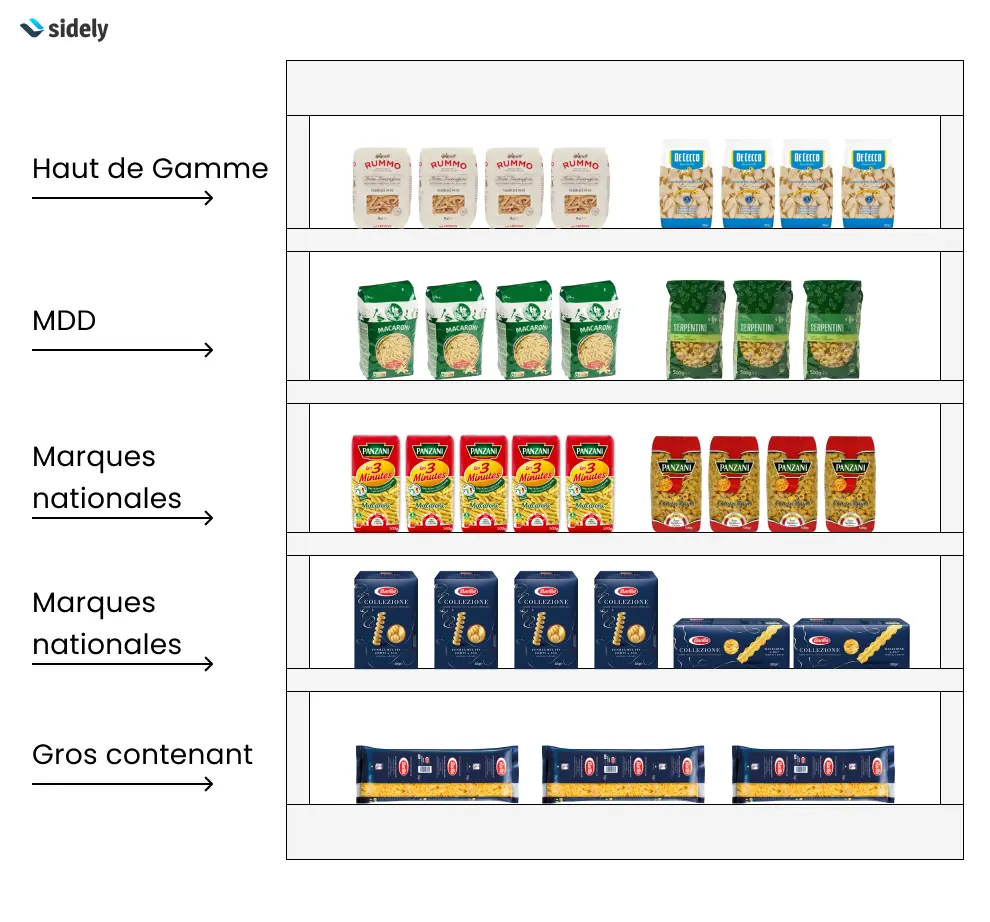

The main idea behind the rule of thirds in supermarkets is to divide shelf or display space into three equal parts, in terms of height or width, using two lines or levels. Each third has a specific purpose for product presentation.

The aim of this strategy is to optimize the use of sales space by highlighting the most important products and making it easier for customers to navigate. This approach can help boost sales by strategically positioning attractive products.

The distributor will give priority to high-margin products, i.e. private labels and new products. He will leave on the lesser-selling thirds, the appeal products and national brands to try to "warm up" the area.

As an Area Manager, it's vital to fight to get these products into the second third of the aisle, as this will mechanically generate turnover and therefore sales. Ideally, you should also succeed in getting your competitors into the 1st and 3rd thirds.

Gondola heads and gondolas also present a less visible facet. In fact, depending on the customer's path, some faces are only partially visible or even invisible, as we don't have 360-degree vision.

On the less visible side, we find complementary products to those featured on the main face.

Always try to make sure when you're negotiating a gondola head that it's on the right side of the road, so that your products are much more visible and you're sure to get a good promotion.

There are two main techniques: vertical and horizontal installation. This can be done according to different criteria. Generally, by brand, segment, price or product. It's also possible to mix them for a pavé layout.

Horizontal presentation

Sort products in ascending order of selling price, according to the direction of customer traffic.

Vertical presentation

Verticality is considered more efficient because :

The reality

This question can be answered very rationally using the brand sensitivity index. The brand sensitivity index is an indicator used to assess the receptiveness and importance of brands in the retail sector. This index measures how customers and consumers react to brands and their presence in a retail environment, such as a supermarket or hypermarket.

Certain segments hold brands with a high sensitivity index. This means that consumers absolutely want their brand and not another. For example: consumers have a high index for shampoo or coffee. If the brand sensitivity index is high, we prefer to set up by brand rather than by product.

For a brand, the dream shelf is a mosaic. This means being the only brand on the shelf. Of course, the reality is more complex, and we're going to find out which are the best positions to take in a shelf.

In France, it's mostly women who do the shopping. Their average height in 2023 was 1.63m. The most popular and accessible areas are between 0.60m and 1.75m. Beyond 1.75m, products are no longer sufficiently accessible, hence the introduction of reminder products.

Combined with the 3/3 rule, we can deduce the most visible, reachable and therefore most profitable areas of a display.

On the scale of a gondola

Take center stage!

Facing refers to the number of times a product is directly visible to the consumer on a shelf. Facing is a key factor in sales. In fact, beyond its position in the store, on the shelf, there is the actual visibility of the product. The more facing your product has, the more visible it will be! That is, up to a certain threshold. Optimizing visibility with facings is based on a very clear mathematical rule: the visibility threshold and the saturation threshold.

It corresponds to the minimum size for a product to be seen by a customer passing through the aisles. A customer is considered to be moving :

At the same time, the eye is able to see a limited number of images per second. That's right! The faster you go, the less you see! Think of your car or TGV journeys.

Threshold of visibility = Speed in m/s / Retinal perception in frames per second

Hot Zone = 2m/s / 3 frames per second = 0.66 m

Cold Zone = 1m/s / 3 frames per second = 0.33 m

The visibility threshold is between 33 cm and 66 cm. This means that facings of juxtaposed products must be at least 33 cm wide to have an impact.

This is the inverse of the visibility threshold. The saturation threshold corresponds to the point at which the size of the facing no longer has any impact on increasing product sales. We consider that beyond 80 cm to 1 m facing width, the product will not be sold any more.